Learn how predictive analytics guided adjuster Mark to accept interventions that saved the insurer 85%, or $55,000 in annual costs, on a long-standing claim.

Predictive analytics identify risky claims and enable early intervention ― critical to controlling costs and mitigating future risk. VitalPoint® Express allows adjusters to easily review and process claims through secure email.

Meet Mark

Mark is an adjuster for a large insurance company in Iowa. A few years ago, Mark worked with a claimant who injured his back while working at a construction company. As a result of his injuries, the claimant underwent two back surgeries and post-op, and received caudal injections, in addition to several medications that had been continuously prescribed since the surgeries.

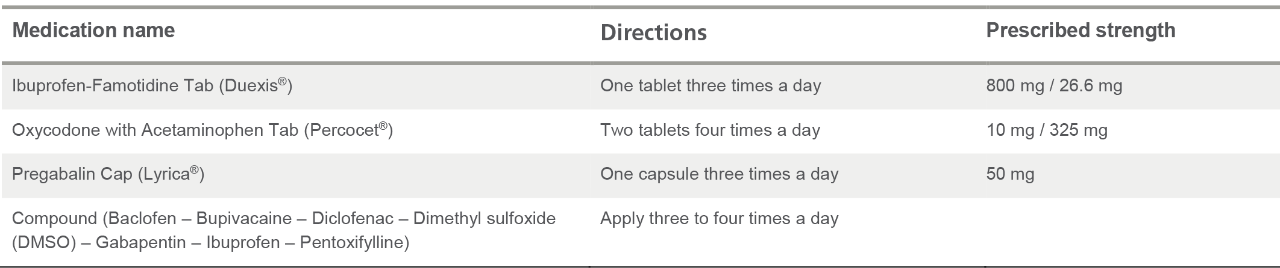

The claimant’s prescription history included:

Switching to Optum for fast, effective clinical oversight

Recently, Mark’s company switched its Pharmacy Benefit Manager (PBM) to Optum. Once the transition was complete, Mark received an email through the Optum VitalPoint® Express system, notifying him that this long-standing claim was identified as a high-risk claim.

VitalPoint Express provides adjusters the ability to easily review and process pending claims via a secure email link. The VitalPoint Express system can be used independently or in conjunction with the full VitalPoint online claims management portal, but both systems include:

- Secure email messages allowing for real-time decisions on pending transactions without login;

- Access to clinical medication information;

- Link to the claimant’s medication history embedded in email; and

- Secure forwarding for authorization requests.

The Optum Predictive Analytics program identifies high-risk claims and enables early intervention which is critical to controlling workers’ compensation costs and mitigating future risk to the claimant. Their team of statisticians use advanced analytics techniques to identify long-term, expensive claims before they develop so intervention tools can be applied sooner. The Optum two-stage multivariate statistical model weighs and measures all the factors with the potential to lead to a high-cost pharmacy claim. Combining this with evidence-based medicine, medical guidelines and the expertise of experienced clinicians determines when and what interventions would be most beneficial.

Mark’s claim was identified through the predictive program as heading to long-term spend. The claim was submitted to the clinical triage pharmacists, where it was determined a Medication Review would benefit this claim. Mark chose to accept the recommendation and ordered the Review.

Pharmacist medication review outcomes

The pharmacist medication review determined there were clinical concerns with Mark’s claimant’s medications, such as drug-drug interactions, excessive morphine equivalent dose (MED), subtherapeutic (low) dose, duplication of therapy, unnecessary medications, and excessive duration of therapy.

The comprehensive pharmacist medication review provides an individualized evaluation of a claimant’s current medication and medical records by a clinical pharmacist to identify any medication-related concerns and develop an action plan for problem resolution. Intended for high-risk, actively managed cases not in the process of settling, the medication review helps ensure the claimant is on the right medication regimen for optimal long-term outcomes – so that dollars are not spent on unnecessary or inappropriate treatment.

Based on the pharmacist medication review of this claimant’s history, peer-to-peer outreach review was recommended.

Peer-to-peer outcomes

The peer-to-peer outreach resulted in several recommendations, including discontinuing Duexis and the compounded medication. The peer reviewer also recommended reducing the frequency of the Percocet to just four tablets a day as needed, thereby reducing MED to align with treatment guidelines. Since the Lyrica dose was low and the claimant continued to complain of nerve pain, optimizing the Lyrica dose and dosing interval to a twice daily regimen was recommended to achieve an appropriate therapeutic level to more adequately treat the claimant’s pain. The prescribing doctor accepted the recommendations and changes were made to the claimant’s medication regimen.

Results

Mark has been pleased with the outcome. “By switching to Optum, I was able to receive actionable insight into my claims, without any added effort. This claim had been open for years with the same medication plan in effect, yet Optum realized that there was a better way to treat this claimant, and save us money – which always makes me look good. All I had to do was hit the “Accept” button.”

Savings

Before the Optum predictive analytics program brought a high-risk claim to Mark’s attention, the annual prescription cost for the claim was $65,601.28. After applying the recommended clinical interventions, the medication costs have been reduced to $10,256.40 per year, an annual savings of over $55,300.